Allstate Insurance in Maryland: Everything You Should Know

Allstate insurance, the fourth-largest auto insurance provider in the nation, offers coverage to a diverse range of drivers and homeowners. But what do Allstate insurance reviews reveal about the company? In this article, VastNetworth will explore Allstate Insurance in Maryland, its benefits, coverage options, average rates, and other pertinent factors. With various coverage options available, comparing companies can enhance your chances of securing the best car and homeowners insurance for your needs. If you’re seeking flexible coverage options and discount incentives, Allstate stands out as an excellent insurance provider to consider. The company currently offers 12 different types of car insurance coverage, along with discounts and telematics insurance programs. While Allstate Insurance is available nationwide, the savings and additional features may vary by state.

Benefits of AllState Insurance in Maryland:

- One of the key advantages of choosing Allstate Insurance in Maryland is the extensive range of insurance packages offered. Whether you require coverage for your car, home, life, or other assets, Allstate has you covered. Customers can address various insurance needs under one roof, simplifying the process and potentially saving money by bundling policies. Allstate offers comprehensive auto insurance coverage, including liability, collision, comprehensive, and optional coverages. Their Accident Forgiveness feature is particularly noteworthy as it ensures that your rates will not increase after your first accident, potentially saving you money in the long run.

- Home Insurance:

- Allstate’s home insurance policies safeguard your home, personal belongings, and liability. Customers can enhance their protection with optional coverage, such as flood insurance.

- Life Insurance:

- Allstate offers a variety of life insurance products, including term life, whole life, and universal life policies, to provide financial protection for your loved ones in the event of your death.

- Renters Insurance:

- For renters in Maryland, Allstate’s renters insurance provides coverage for personal belongings and liability, offering peace of mind.

- Additional Coverage:

- Allstate also provides coverage for motorcycles, yachts, and other vehicles, catering to a wide range of customer needs.

- Accessibility and Local Presence:

- Allstate Insurance maintains a significant presence in Maryland, ensuring accessibility to individuals throughout the state. With numerous companies and licensed agents in Maryland, consumers can easily explore their insurance options, discuss their specific needs, and receive personalized advice. Local Allstate agents can be especially helpful when addressing concerns or seeking assistance with insurance plans.

- Financial Stability and Reliability:

- Allstate is renowned for its financial stability and reliability, factors crucial when selecting an insurance provider. Customers trust Allstate’s ability to fulfill their insurance commitments due to the company’s strong financial standing.

- Beneficial Features and Discounts:

- Allstate Insurance in Maryland offers several beneficial features and incentives to help clients save money. Examples include:

- Accident Forgiveness: Prevents rate increases after the first accident.

- Safe Driving Bonus Check: Rewards safe drivers with a bonus every six months for remaining accident-free.

- Bundle Discounts: Savings available by bundling multiple policies such as auto and home insurance.

- Claim Satisfaction Guarantee: Ensures a favorable claims experience for clients.

- New Car Replacement: Assistance with replacing totaled vehicles within the first three model years.

- Multiple Payment Options: Convenient payment plans including the Easy Pay Plan.

- Allstate Car Insurance Costs:

- Allstate’s prices generally exceed the national average. For example, the typical cost of full-coverage Allstate insurance for a 35-year-old married driver with acceptable credit and a clean driving record is approximately $2,598 per year or $216 per month. This exceeds the national average across all companies, which stands at $2,008 for the same demographic.

- Factors Affecting Allstate Costs:

- Various factors influence Allstate insurance costs, such as credit score, driving history, and location. Allstate auto insurance tends to be more expensive in certain states, including Maryland, due to factors such as population density and at-fault accidents. Additionally, demographics like age, gender, marital status, and vehicle type impact insurance rates.

- In conclusion, Allstate Insurance in Maryland offers comprehensive coverage options, beneficial features, and local accessibility. While Allstate’s rates may be higher than the national average, the company’s financial stability and reliable service make it a preferred choice for many customers. To obtain the best insurance offer, understanding the factors influencing insurance rates is essential. By considering various aspects and comparing quotes, you can make an informed decision regarding your insurance coverage.

What Factors Affect Allstate Home Insurance Costs?

The cost of home insurance can vary based on several factors, including location, property details, and coverage needs. When seeking home insurance, consider the following points:

- Location: The city and state where your home is located can impact your insurance premiums. Coastal or disaster-prone states typically have higher rates, while inland states tend to have lower rates.

- Claim History: Homeowners who have filed claims in the past three to five years may experience higher rates. Discuss your previous claims with an Allstate specialist to get an accurate quote.

- Property Features: Certain features like pools or trampolines can increase insurance costs due to added liability risks.

- Coverage Requirements: Homes with higher values require higher insurance limits to cover repair or rebuilding costs after incidents or disasters.

- Deductible: Opting for a lower deductible may result in higher premiums. Consider increasing your deductible if it fits your budget to secure lower rates.

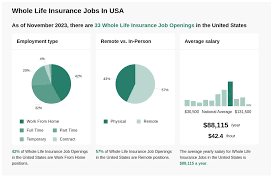

Is Allstate life insurance good? Allstate Life Insurance Company offers four types of life insurance policies:

- Term Life Insurance: Provides affordable protection for a specific period, typically the cheapest option for temporary coverage. It can supplement income for your family in case of your death during your earning years.

- Universal Life Insurance: Offers flexible coverage lasting your entire life, with various cash accumulation options.

- Whole Life Insurance: Provides guaranteed coverage with fixed premiums and death benefits, typically tax-free for your beneficiaries.

- Variable Life Insurance: Offers investment options for cash value growth and flexibility in death benefits.

In conclusion, Allstate provides attractive features for Maryland drivers and homeowners seeking quality insurance with financial strength and exceptional service. While not the cheapest option, its reputation for outstanding claims service and local presence can offer significant benefits. With customizable coverage options and accessible discounts, Allstate ensures tailored policies to meet specific needs. Regularly reviewing your policies with a local agent can help ensure you’re getting the best value. With over 20 million clients nationwide, Allstate’s commitment to quality products and service makes it a trusted insurance partner for many.