In today’s dynamic job market, exploring diverse career options is essential. One often overlooked but rewarding field is the life insurance industry. We will provide every vital information to address the topic of concern “How Many Jobs Are Available in Life Insurance”

The insurance sector isn’t just about selling policies; it offers a multitude of job opportunities that cater to various skills and interests. In this article, we will delve into the world of life insurance, highlighting the plethora of career options available within the industry.

What is Life Insurance?

Life insurance constitutes an agreement between a life insurance company and a policyholder. Under this arrangement, the insurance company disburses a predetermined sum to the insured individual following a specified duration or to the beneficiaries designated by the policyholder upon their demise.

To qualify for the associated benefits, the insured party submits a solitary upfront premium payment or recurring premiums, often on an annual basis, throughout their lifetime.

There are two primary categories of life insurance: term life insurance policies and permanent life insurance policies. Term life policies have a defined expiration after a specific number of years, whereas permanent life insurance remains in force until the insured ceases premium payments or passes away.

How Many Jobs Are Available in Life Insurance

According to the Insurance Information Institute, at the time of writing, there are currently 2.9 million individuals employed in the broader insurance industry within the United States. A detailed breakdown can be observed in the table provided below.

| Year | Life & Health | Property/casualty | Reinsurers | Agencies & Brokers | Other | Total |

|---|---|---|---|---|---|---|

| 2018 | 882,8oo | 629,500 | 28,600 | 825,600 | 346,200 | 2,712,700 |

| 2019 | 931,200 | 650,300 | 28,600 | 842,800 | 349,500 | 2,802,300 |

| 2020 | 945,600 | 653,900 | 27,600 | 856,500 | 352,300 | 2,835,900 |

| 2021 | 908,700 | 646,900 | 28,100 | 886,600 | 354,500 | 2,824,900 |

| 2022 | 902,600 | 686,300 | 30,100 | 927,600 | 361,100 | 2,907,700 |

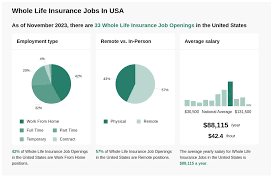

As evident from the data, the insurance sector, as a whole, has experienced significant growth in the United States, with life and health insurance playing a pivotal role in driving this expansion. Now, let’s delve into the specific numbers for the life insurance industry. According to Zippia, the life insurance industry employs 911,000 individuals directly, while an additional 2.8 million work in associated businesses that offer brokerage services or related support within the industry.

| Job title | U.S. jobs | 2020-2030 job growth rate | Job openings |

|---|---|---|---|

| Insurance sales agent | 174,000 | 10% | 96,000 |

| Insurance broker | 157,000 | 10% | 51,000 |

| Claims adjuster | 132,000 | -4% | 18,000 |

| Claim processor | 121,000 | -4% | 13,000 |

| Insurance specialist | 117,000 | 5% | 94,000 |

| Insurance clerk | 109,000 | 5% | 167,000 |

| Life insurance agent | 104,000 | 10% | 94,000 |

| Underwriter | 97,000 | -5% | 10,000 |

| Medical coder | 92,000 | 11% | 36,000 |

| Risk analyst | 8,000 | 6% | 72,000 |

The outlook for careers as life insurance agents indicates a projected growth of 10 percent from 2020 to 2030. While many positions in the life insurance sector typically necessitate a college degree, there are also a handful of blue-collar jobs accessible within the industry. Let’s explore some of the leading professions suited to various skill sets.

Exploring the Vast World of Life Insurance Careers

Life insurance is a broad and multifaceted industry, providing numerous career paths. Let’s explore some of the exciting opportunities it has to offer:

- Underwriting

Underwriters play a critical role in assessing risk and determining policy eligibility. They analyze data, financial records, and health information to make informed decisions about insurance coverage.

- Sales and Marketing

Sales and marketing professionals are responsible for promoting insurance products. They create marketing campaigns, connect with potential clients, and help individuals find the right insurance solutions for their needs.

- Actuarial Science

Actuaries use mathematical models to analyze risks and help insurance companies set premium rates. Their work is crucial in maintaining financial stability within the industry.

- Claims Adjusters

Claims adjusters investigate insurance claims, assess damages, and negotiate settlements. They ensure that policyholders receive the compensation they are entitled to.

- Customer Service

Customer service representatives are the front line of insurance companies, assisting policyholders with inquiries, claims, and policy adjustments.

- Risk Management

Risk managers identify, assess, and mitigate potential risks for insurance companies. They play a pivotal role in maintaining financial stability and minimizing losses.

- Insurance Brokers

Insurance brokers act as intermediaries between insurance companies and clients. They help individuals and businesses find the best insurance policies to meet their specific needs.

- Loss Control Specialists

Loss control specialists work with policyholders to assess and minimize risks in various settings, such as homes, businesses, or construction sites.

- Health Insurance Advisors

Specializing in health insurance, these advisors assist clients in understanding and selecting suitable health coverage options.

- Regulatory Compliance

Professionals in regulatory compliance ensure that insurance companies adhere to legal and ethical standards, protecting both the company and its clients.

FAQs on “How Many Jobs Are Available in Life Insurance”

Q: What qualifications are typically required to work in the life insurance industry?

A: Qualifications vary depending on the specific job, but many positions may require a bachelor’s degree and relevant certifications. Sales roles often focus on interpersonal skills and sales experience.

Q: Is there a high demand for professionals in the life insurance industry?

A: Yes, there is a consistent demand for professionals in the life insurance industry. People will always need insurance coverage, and the industry continues to evolve, creating new opportunities.

Q: Are there opportunities for career advancement in the life insurance sector?

A: Absolutely. Many professionals start in entry-level positions and work their way up through experience and additional qualifications. The industry values growth and development.

Conclusion

The life insurance industry offers a vast array of job opportunities for individuals with diverse skills and interests. Whether you’re passionate about sales, data analysis, risk management, or customer service, there’s a place for you in this dynamic sector. Having provided information on “How Many Jobs Are Available in Life Insurance” If you’re looking for a rewarding career with the potential for growth and advancement, the world of life insurance is a promising choice.

Don’t miss out on the numerous opportunities within the life insurance industry. Explore the possibilities, build your skills, and embark on a fulfilling career path in an industry that is both stable and ever-evolving.