When it comes to auto accidents in New Jersey, one common question that often arises is “Does Police Report Automatically Go to Insurance in NJ”. Understanding the process is essential for anyone living in the Garden State. In this article, we’ll delve into this important topic, providing you with valuable insights and expert guidance on what you need to know. So, let’s start by addressing the key question: Does a police report automatically go to insurance in NJ

Does Police Report Automatically Go to Insurance in NJ

In certain situations, the police report doesn’t automatically get forwarded to the insurance company. This occurs because the report doesn’t serve as an indisputable, legally binding declaration of guilt or innocence on your part. However, typically, one of the parties involved will proactively send the report to the insurance company to support their perspective and furnish evidence that may indicate who should be held responsible for the incident.

What Happens After an Accident in NJ?

After being involved in an accident in New Jersey, you may be wondering how the information reaches your insurance company. To answer this question, we must explore the standard procedures that follow a car accident:

- The Initial Police Report

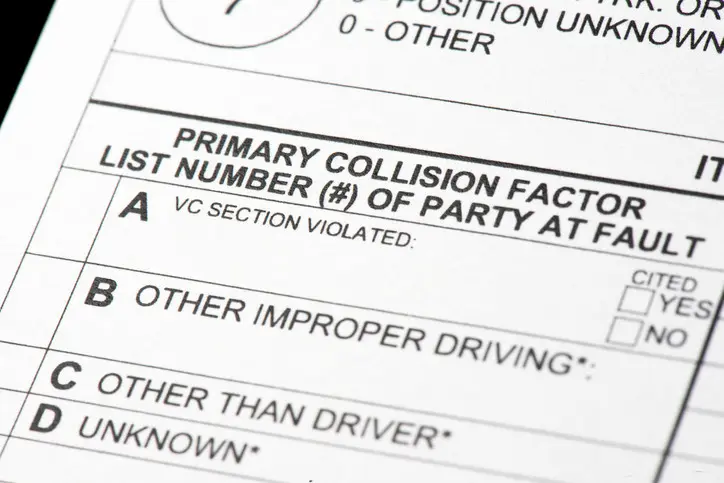

The process begins with the police arriving at the accident scene. They gather information, take statements from those involved, and create an official police report detailing the incident.

- Submitting the Report

Once the police report is complete, it is typically submitted to the police department and the New Jersey Department of Transportation. This report serves as a crucial piece of documentation in any accident case.

- Your Insurance Company

While the police report itself is not automatically sent to your insurance company, it is available for them to obtain. Most insurance companies actively seek out these reports when they are made aware of an accident involving one of their policyholders.

- Reporting the Accident

It’s essential to report the accident to your insurance company promptly. They will guide you through the claims process and determine the extent of coverage based on the details of the police report.

The Role of the Police Report

- Assessing Liability

The police report plays a critical role in assessing liability after an accident. Insurance companies use this report to determine who is at fault and to what degree.

- Claim Processing

Once the accident is reported to your insurance company, they use the police report as one of the key documents in processing your claim. The report’s information helps in evaluating the extent of the damage, injuries, and other relevant factors.

FAQs About “Does Police Report Automatically Go to Insurance in NJ”

Q: Is it mandatory to file a police report after an accident in NJ?

A: While it’s not mandatory for minor accidents, it is advisable to file a police report for any accident involving injuries, significant damage, or disputes over liability.

Q: How soon should I report the accident to my insurance company?

A: It’s best to notify your insurance company as soon as possible after an accident. Timely reporting ensures a smooth claims process.

Q: What if the police report contains errors or inaccuracies?

A: You can contact the police department to request corrections to the report. It’s essential to have an accurate report for insurance purposes.

Q: Will my insurance rates increase if I file a claim?

A: It depends on various factors, including your insurance company’s policies, your driving history, and the circumstances of the accident. Your rates may increase, but not in every case.

Q: Can I choose not to involve my insurance company and settle privately?

A: You have the option to settle privately, but it’s crucial to be cautious when doing so, especially if there are injuries involved. Consult with your insurance company before making a decision.

Q: What if the other party involved doesn’t have insurance?

A: If the other party is uninsured, you may need to rely on your insurance coverage. Uninsured/underinsured motorist coverage can help in such situations.

Conclusion

In conclusion, a police report generated after an accident in New Jersey doesn’t automatically go to your insurance company. However, it serves as a vital document that insurers often seek out. Reporting the accident promptly and accurately to your insurance company is crucial for a smooth claims process. Remember, the police report plays a significant role in assessing liability and processing your claim. If you have any doubts or questions about the process, consult your insurance provider for guidance.