Massachusetts Car insurance – Reviews, Requirements & Costs

Massachusetts car insurance is compulsory for all drivers in the state, serving to safeguard both drivers and pedestrians in case of accidents. This article delves into the intricacies of Massachusetts car insurance, covering its requirements, available coverage options, and factors to consider when selecting a policy.

The Guides Auto Team has meticulously researched the most economical car insurance companies in the country, analyzing their coverage offerings, reputation, customer service, and pricing for Massachusetts auto insurance. Below are our findings.

While car insurance rates in Massachusetts slightly exceed the national average, affordable coverage options are still attainable. Here, we highlight the cheapest car insurance providers and coverage selections in the Bay State, starting with the most budget-friendly options.

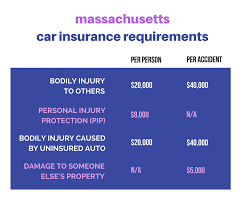

Massachusetts Car Insurance Requirements:

Massachusetts law mandates drivers to carry specific types of car insurance coverage, including:

- Bodily Injury Liability

- Personal Injury Protection (PIP)

- Property Damage Liability

- Uninsured Motorist Coverage

Cheapest Car Insurance Companies in Massachusetts:

Our top picks for the best car insurance in Massachusetts are Geico, USAA, Amica, Travelers, and Arbella. These providers offer dependable coverage plans and exceptional customer service statewide.

Cheap Auto Insurance Quotes in Massachusetts:

Various factors such as age, location, driving history, and credit score impact insurance premiums. Here’s a breakdown of cheap car insurance estimates for Massachusetts drivers:

- Cheapest Car Insurance for Young Drivers in Massachusetts:

- Geico typically offers the most affordable car insurance for 16-year-old drivers at around $6,634 annually.

- For 17-year-olds, Geico also tends to have the lowest rates, averaging $6,296 annually.

- 18-year-old drivers can find relatively inexpensive coverage with Geico, averaging $6,007 annually.

These rates are based on a 35-year-old driver with good credit and a clean driving record. However, prices may vary depending on individual circumstances.

In conclusion, while car insurance rates in Massachusetts may surpass the national average, diligent comparison shopping can lead to finding suitable coverage at competitive prices.

Cheapest Massachusetts Car Insurance for 21-Year-Olds

Geico typically offers the lowest rates on coverage for 21-year-old drivers in Massachusetts with an average estimated cost of $3,581 per year, or $298 per month. The average rate in Massachusetts for 21-year-old drivers is $4,818 per year or $402 per month. This is 82% more expensive than the average estimate for drivers in the state.

| Cheapest Car Insurance in Massachusetts | Estimated Monthly Cost | Estimated Annual Cost |

| Geico | $298 | $3,581 |

| Metropolitan Group | $323 | $3,875 |

| Progressive | $333 | $4,001 |

| The Hanover Insurance Group | $334 | $4,010 |

| Amica | $389 | $4,669 |

Cheapest Massachusetts Car Insurance for 25-Year-Olds

For 25-year-old drivers in Massachusetts, Metropolitan Group typically provides the most affordable car insurance, averaging around $2,340 per year or $195 per month. Comparatively, the average estimate for 25-year-olds in Massachusetts is approximately $2,929 per year or $244 per month, representing an 11% increase over the state’s average.

| Cheapest Car Insurance in Massachusetts | Estimated Monthly Cost | Estimated Annual Cost |

| Metropolitan Group | $195 | $2,340 |

| Amica | $196 | $2,346 |

| Geico | $197 | $2,367 |

| Allstate | $229 | $2,743 |

| Arbella Insurance | $268 | $3,214 |

Cheapest Massachusetts Car Insurance for High-Risk Drivers

Drivers categorized as high-risk due to recent accidents, speeding tickets, or DUIs often face significantly higher car insurance premiums. Below are estimates for the cheapest car insurance rates in Massachusetts for drivers falling into these categories.

Cheapest Massachusetts Car Insurance for Drivers With a Speeding Ticket:

Receiving a speeding ticket usually results in higher insurance costs. On average, Massachusetts drivers with recent speeding tickets pay approximately $3,271 per year or $273 per month for full coverage insurance. Here’s a breakdown by insurance company:

- Geico: $144 per month ($1,729 per year)

- USAA: $161 per month ($1,942 per year)

- Arbella: $182 per month ($2,179 per year)

- Plymouth Rock: $221 per month ($2,657 per year)

- Amica: $272 per month ($3,266 per year)

Cheapest Massachusetts Car Insurance for Drivers With a Recent Accident:

Being involved in a car accident often leads to substantial premium increases. On average, Massachusetts drivers with recent accidents pay around $4,257 per year or $355 per month for full coverage insurance. Here are estimates from various insurance providers:

- Geico: $187 per month ($2,243 per year)

- USAA: $196 per month ($2,357 per year)

- Arbella: $219 per month ($2,632 per year)

- Plymouth Rock: $224 per month ($2,682 per year)

- Travelers: $345 per month ($4,140 per year)

Cheapest Massachusetts Car Insurance for Drivers With a DUI:

A DUI conviction often results in significantly higher insurance rates. On average, drivers with a DUI in Massachusetts pay approximately $3,196 per year or $266 per month for full coverage insurance. Here are estimated rates from different insurance companies:

- Geico: $211 per month ($2,534 per year)

- Plymouth Rock: $229 per month ($2,747 per year)

- Progressive: $286 per month ($3,431 per year)

- Arbella: $326 per month ($3,915 per year)

- Travelers: $331 per month ($3,967 per year)

Car Insurance Deals in Massachusetts:

Many car insurance companies offer various discounts and deals for Massachusetts drivers. Some common discounts include multi-policy, multi-vehicle, safe driver, student, defensive driving, and driver training discounts, among others. Discounts may vary by state, so it’s advisable to inquire with an insurance agent about available discounts.

Companies With the Best Auto Insurance Rates in Massachusetts:

For those seeking affordable car insurance in Massachusetts, several providers offer competitive rates. These include Geico, USAA, Amica, Travelers, and Arbella. Each of these companies has its unique offerings and discounts tailored to Massachusetts drivers.

Average Car Insurance Cost Massachusetts

Based on our data, the average annual cost of full coverage car insurance in Massachusetts stands at $2,647, equating to around $221 per month. This figure represents a 53% increase compared to the national average of $1,730 per year, placing Massachusetts among the top 10 most expensive states for auto insurance.

Let’s take a closer look at how Massachusetts fares in terms of car insurance costs compared to the rest of the nation:

Massachusetts Car Insurance Cost by Age:

The cost of car insurance in Massachusetts varies significantly depending on the driver’s age. Here’s a breakdown of average monthly and annual insurance costs for drivers of different age groups in the state:

Massachusetts Car Insurance Cost by City:

Location plays a crucial role in determining car insurance rates, with different areas within Massachusetts carrying varying risk factors. Below are the average monthly and annual insurance rates for the top 25 most populated cities and towns in the state:

Factors Affecting Massachusetts Car Insurance Rates:

Insurance companies consider several factors when determining insurance rates, including age, marital status, driving record, credit score, and location.

Massachusetts Car Insurance Requirements:

Massachusetts operates under no-fault laws, meaning insurance providers cover expenses resulting from accidents up to the policy limit, regardless of fault. The state’s minimum car insurance requirements include:

- Bodily injury liability: $20,000 per person, $40,000 per accident

- Property damage liability: $5,000 per accident

- Uninsured motorist bodily injury coverage (UM): $20,000 per person, $40,000 per accident

- Personal injury protection (PIP): $8,000 per accident

Consequences of Driving Without Insurance in Massachusetts:

Driving without proper insurance in Massachusetts is illegal and can lead to severe penalties, including fines, license and registration suspension, and even incarceration.

How to Obtain Car Insurance in Massachusetts:

Massachusetts drivers can easily compare insurance quotes online, ensuring they find the best coverage at competitive rates. It’s essential to have information about your vehicle and drivers ready when shopping for insurance.

Conclusion:

Progressive tends to offer the most affordable car insurance in Massachusetts for most drivers. However, the best provider for you depends on your individual circumstances and needs. Massachusetts car insurance is mandatory and provides crucial protections in case of accidents. It’s vital to understand the state’s insurance requirements and choose a policy that aligns with your budget and preferences. Comparing quotes from multiple insurers and exploring available discounts can help you secure the most suitable coverage at the best price.