In the vast landscape of the insurance industry, one key player takes center stage: the Insurance Producer. But what is insurance producer, and why are they so crucial to the functioning of the insurance ecosystem? This article sheds light on the topic of What is Insurance Producer?

What is Insurance Producer?

An insurance company’s policies are sold and serviced by an insurance producer. Contacting leads and assisting them with their insurance requirements are among your responsibilities as an insurance producer. Getting them set up with a policy from your business is your aim.

Additionally, you assist current clients in adding new coverage or updating their plans. Depending on the sort of insurance your company offers, your particular responsibilities may change. You market health insurance and motor insurance, for instance, in different ways. A health insurance producer may generate a significant amount of revenue from company health plans, even though the latter focuses mostly on individual clients. Whatever the situation, it is your responsibility to increase revenue for your agency by offering top-notch insurance choices and first-rate customer support.

The term “insurance producer” is interchangeable with independent agent, captive agent, insurance representative or insurance broker.

How to Become an Insurance Producer

What an Insurance Producer Does

Insurance producers are licensed to sell and negotiate life, health, property, or other types of insurance offered by an insurance company. As an insurance producer, you may work for one insurance company only or represent multiple carriers.

Being a producer includes finding new clients and maintaining relationships with those you already have. Insurance producers need to be a reliable first point of contact when a client needs to file a claim or increase coverage due to major life events, like purchasing a new car or having a child. Other responsibilities include:

- Calculating premiums and establishing payment methods

- Monitoring insurance claims and helping clients settle them

- Fulfilling all policy requirements

- Customizing insurance programs to suit individual customer needs

- Inspecting property to examine its overall condition and decide its insurance risk

- Acting as an intermediary between a customer and the insurance company

Insurance Producer Skills

Insurance producers use sales skills and customer service to gain new clients, keep existing clients happy, and build strong, ongoing relationships. Insurance agencies seek candidates who have the specific skills required for continued success at this job:

- Sales skills – insurance producers use sales techniques to gain new clients

- Customer service – insurance producers use customer service skills to keep existing clients happy

- Communication skills – insurance producers use strong verbal communication skills to speak with clients and interact with other office members

- Analytical thinking – insurance producers use analytical skills to assess insurance policy risks

- Computer skills – insurance producers enter information into computer systems to create new insurance policies and proposals, which requires excellent computer skills

- Interpersonal skills – insurance producers are ultimately sales professionals who must build and foster relationships with clients, which requires them to have exceptional interpersonal skills

- Problem-solving skills – insurance producers use problem-solving skills to appease angry or upset customers.

Requirements and Qualifications

- Bachelor’s degree in Business, Finance, or related field

- Proven experience as an insurance producer

- Knowledge of insurance regulations and policies

- Excellent communication and interpersonal skills

- Able to build relationships with clients

- Strong problem-solving and analytical skills

- Proficient in Microsoft Office Suite and customer relationship management (CRM) software

Conclusion

In the intricate world of insurance, producers play a pivotal role, acting as the bridge between clients and comprehensive coverage. Their multifaceted responsibilities, coupled with the challenges and opportunities presented by a dynamic industry, make the role of an insurance producer both demanding and rewarding.

FAQs

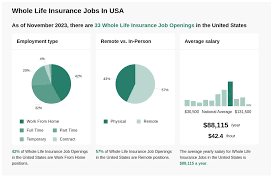

1. How much does an insurance producer earn?

Earnings vary based on factors like experience, location, and specialization. On average, insurance producers earn a competitive income, often supplemented by commissions.

2. Can I become an insurance producer without a college degree?

Yes, a college degree is not always mandatory. However, pursuing relevant education and certifications can enhance your credibility and prospects.

3. What is the difference between an agent and a broker?

While both sell insurance, agents work for specific companies, whereas brokers are independent and can offer policies from multiple insurers, providing a broader range of options.

4. How do insurance producers adapt to technological changes?

Successful insurance producers embrace technology, utilizing CRM systems, digital marketing tools, and online quoting platforms to enhance efficiency and client interactions.

5. Are there specific insurance products that are more profitable for producers?

Profitability varies, but products like life insurance and commercial insurance often offer higher commissions. However, success depends on individual strengths and market demands.